Setting up STP

Before you can use Single Touch Payroll, you need to configure your Accentis Enterprise installation. If you are already using Accentis Enterprise as your payroll provider, then you are almost there. If you currently don't use the payroll module in Accentis Enterprise, you can contact Support for more information.

To use Single Touch Payroll within Accentis Enterprise, the following is required:

- Accentis Enterprise version 6.17.07 or above

- .Net 4.5+ to be installed on the PC running Accentis Server

- Internet access on the PC running Accentis Server

- Access to your chosen STP transport providers website

Accentis Enterprise does not transfer STP data direct to the ATO. We integrate with STP-compliant Transport Providers who will send the data securely to the ATO. Choose one of the STP transport providers that Accentis integrates with and contact them to organise an account.

Select a Transport Provider below to register with them.

Accentis integrates with the following STP providers to send your Single Touch Payroll data to the ATO. Transport Providers will charge you based on the amount of data that is sent through their system. Accentis Enterprise does not charge you to connect to a Transport Provider.

If you would prefer to use another provider you are able to, provided the Transport Provider supports a manual file upload process.

Ozedi

CLICK HERE for everything you need to know about Ozedi as your Transport Provider. During registration, Ozedi will provide you with a quick start guide for their service. You only require 1 Client ID.

CLICK HERE if you have already registered with Ozedi.

MessageXchange

CLICK HERE for everything you need to know about MessageXchange as your Transport Provider.

Other (FILE)

You are able to manually send your information to the ATO using a different Transport Provider as long as they support a manual file upload process. CLICK HERE for more information on using another provider.

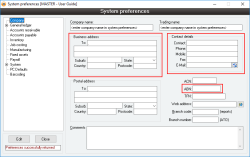

The following preferences can be found under System > Preferences: Company Tab

These are the contact details of your company or enterprise. These details are used for reference purposes in reports. The Contact, Phone and E-mail are also included as the contact details for Single Touch Payroll lodgments.

- ABN: The ABN that represents the entity submitting payroll data

- Company contact details

- Email address: If specified, must contain a valid email address

- Phone number: If specified, must only contain numerical values and spaces only. Do not include formatting such as brackets, hyphens or hash symbols.

- Business address

- State: Must contain a valid Australian state (Full state name or abbreviation)

- Postcode: Must contain a valid Australian postcode in the range 0000 – 9999

- Country: Must be empty, AU, AUS or Australia

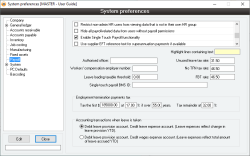

The following preferences can be found under System > Preferences: Payroll Tab

- Enable Single Touch Payroll: Determines whether Single Touch Payroll functionality is available within Accentis Enterprise. This option must be enabled in order to perform Single Touch Payroll lodgments from within Accentis Enterprise.

- BMS ID: This is a unique identifier for Single Touch Payroll that is assigned to this Accentis Enterprise database. Once generated, it cannot be edited or removed. In Add/Edit mode, a "Generate" button will allow a GUID to be generated as the BMS ID and only if the BMS ID is not already present. This field must be set before lodging Single Touch Payroll data with the ATO. Contact Support for more information if required.

The two preferences above must be configured to allow lodgment of STP details to the ATO.

The following preference can be found under System > Users > Users

- User’s name: - Ensure that the name of the Accentis Enterprise user that is lodging the STP data (their “User’s name” under System > Users > Users) is an actual, real person’s name. This is used on the declaration to the ATO.

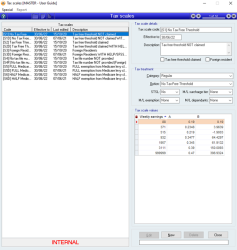

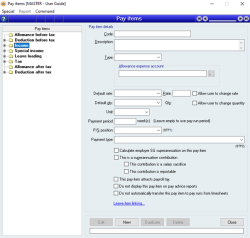

Each tax scale has a "tax treatment" and if you have customised tax scales, you will need to create these and set this tax treatment before you can use the tax scale for the first time. If you are using the standard tax scales that we distribute, then you will not have to do anything.

*Internal tax scales have been set by default and cannot be changed.

As with existing end of payroll financial year processing, Employees data should be checked for accuracy. When using a non-standard basis of employment, the name must contain "Full time", "Part time", "Death Beneficiary" or "Casual" as part of the name to pass STP validation.

This includes but is not limited to:

- Home address

- Address line 1: Must contain an Australia address. This field can not be left empty.

- State: Must contain a valid Australian state (Full state name or abbreviation)

- Postcode: Must contain a valid Australian postcode in the range 0000 – 9999

- Country: Must be empty, AU, AUS or Australia

- Contact details

- Email address: If specified, must contain a valid email address

- Phone number: If specified, must only contain numerical values and spaces only. Do not include formatting such as brackets, hyphens or hash symbols.

- Date of birth

- If specified, must be a valid date format and must be prior to the current date

- Status

- A basis of employment must be selected. If using non-standard basis of employment, the name must include "Full time", "Part time", "Death Beneficiary", or "Casual" as part of the name to pass STP validation.

- Income stream

- An income stream must be specified for the employee. This will be the default income stream for the employee in the pay run. If an employee has multiple income streams, the income stream can be changed on the pay run to accommodate this.

- Country code

- You must report the country code for employees that are paid the following income streams

- Foreign employment income (FEI)

- Inbound assignees to Australia (IAA)

- Working holiday makers (WHM)

- If you make payments to

- An Australian resident working overseas - Use the host country code

- A working holiday maker or inbound assignee - Use their come country code

- You must report the country code for employees that are paid the following income streams

- Tax file number settings

- Must contain a valid TFN or an ATO approved replacement.

- If a tax file number declaration has been signed by an employee prior to commencing single touch payroll, ensure the "TFN declaration has been reported to ATO" option is ticked and enter the date the declaration was signed in the "Date signed" field.

- If a declaration has been signed, but the date of signing is unknown, leave the date field empty rather than using a place-holder date.

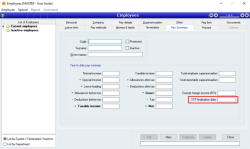

- STP finalisation date

- This field should initially be set to 30th June of the financial year prior to starting with single touch payroll.

- For example: If you are starting single touch payroll on July 1st 2018, this field should be set to 30/06/2018

- This field should initially be set to 30th June of the financial year prior to starting with single touch payroll.

Ensure your payroll staff have been granted ADD Permissions on the Single touch payroll function. Only users with these permissions can lodge Single touch payroll data.

- Fields affected by STP

- How does STP work in Accentis Enterprise

- How to setup MessageXchange as the STP Transport Provider

- How to setup Other (FILE) as the Transport Provider

- How to setup Ozedi as the STP Transport Provider

- More information & resources on STP

- SA4422 - STP Dashboard

- Setting up STP

- Single Touch Payroll – Your first Pay Run in Accentis

- Single Touch Payroll (STP)

- Single Touch Payroll FAQs

- STP Finalisation and Lodgment

- STP Phase 2 (STP2)

Last edit 23/12/21